Designing a Resilient Autopay System

Role

Lead Designer

The Focus: Reducing cognitive load in financial scheduling and driving adoption through behavioral design.

Problem & Goal: Reducing Friction in Recurring Payments

Many users avoided automated payments altogether because they felt they lacked control over their budgeting and deadlines.

The Challenge: How do we encourage users to trust a recurring system when they have strict, manual budgeting habits?

The Goal: Streamline the transaction flow and increase the adoption of recurring and custom payment features by making them feel like a natural part of the payment journey.

Collaboration: Bridging the Gap Between Data and Design

I acted as the bridge between analysts, project managers, and the engineering team to ensure our design solutions were technically feasible and aligned with business goals.

I proactively connected with data analysts to understand user behavior patterns within the app, allowing me to design for real-world scenarios rather than assumptions.

Cross-Functional Alignment: I led the effort to translate technical constraints into a polished user experience that satisfied both the legal requirements of banking and the needs of the end user.

Research & Ideation: The Psychology of Scheduling

Through group interviews with 40 users, we discovered that the biggest barrier to Autopay wasn't a lack of interest, but a lack of flexibility. Users wanted to automate, but they needed to choose exactly when that automation happened.

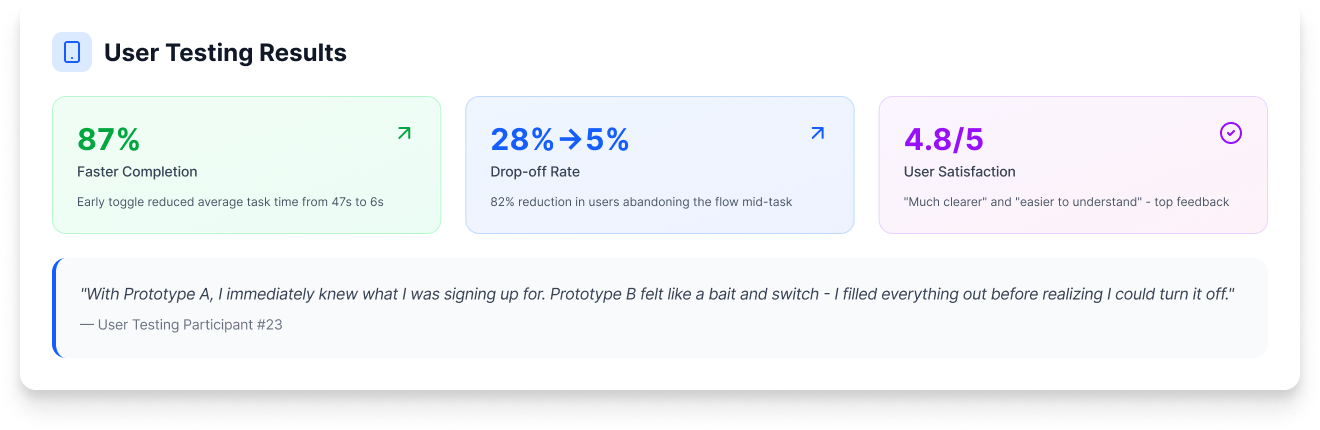

We tested two prototypes to find the optimal placement for the recurring toggle. We discovered that placing the toggle after date selection (Prototype A) significantly reduced backtracking and improved conversion.

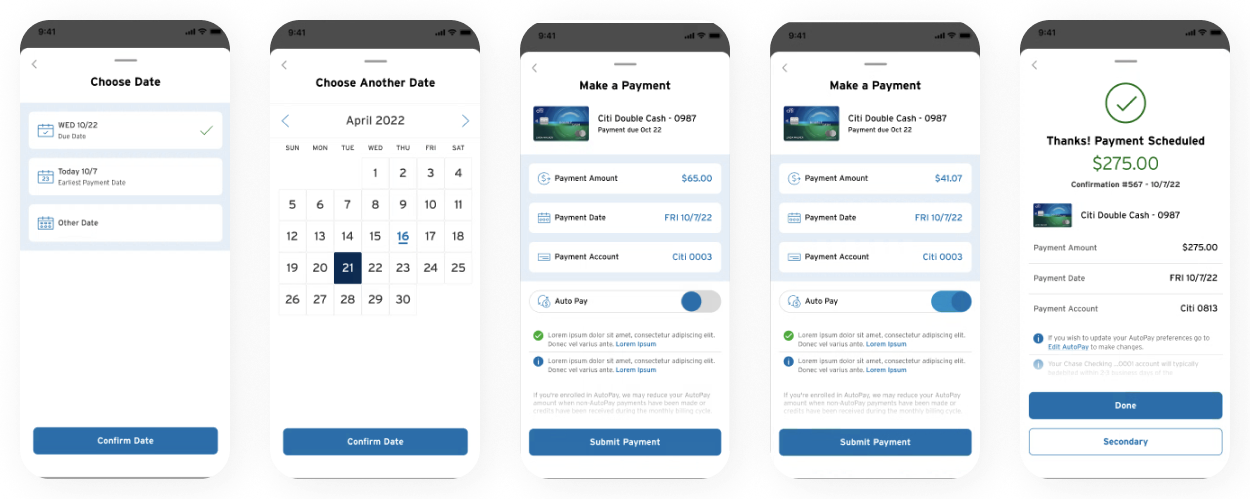

We simplified the "when" by offering two intuitive paths: "Today's Date" for immediate needs or "Deadline" as well as “Custom Date'' for futureproofing.

Hi-Fi Overview

This flow eliminates the standard calendar clutter by offering two primary, high-intent buttons: "Today" or "Deadline." This simplifies the decision-making process for users who are on the go.

Instead of making Autopay a separate, intimidating flow, I integrated it directly into the payment submission screen. The toggle sits right below the final review details, making subscription management feel like a simple add-on.

The Final Review Modal: Trust is built through confirmation. This screen acts as a final safety net, clearly summarizing the "Amount," "Date," and "Recurring Status" before the user swipes to pay.

Business Results

30% Adoption Increase: We saw a significant jump in users opting into recurring payments after we implemented the Prototype A flow.

Surge in Custom Usage: Users felt more empowered to use custom payment dates, leading to higher overall satisfaction with the mobile experience.

Efficiency Gains: The streamlined date selection reduced the average time-to-completion for transactions, proving that clarity is the ultimate driver of speed in fintech.