Pinto: Humanizing the Automated Orderbook

Protocol Outcomes: Scalability & Adoption

Since launch, the pinto protocol has seen significant growth in total value locked and a 42% marked increase in user execution confidence.

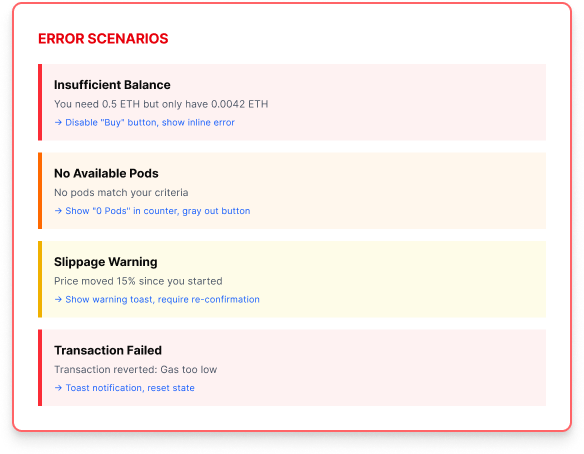

Reduced Error: By prioritizing clarity over jargon, we opened the doors for retail users who were previously intimidated by the "black box" of defi.

Infrastructure: The design system I built now allows the engineering team to ship new features with high precision and zero design debt.

Role

Lead Designer. Working with Two back-end and one front end engineers

Problem & Goal: Paying Down the Usability Debt

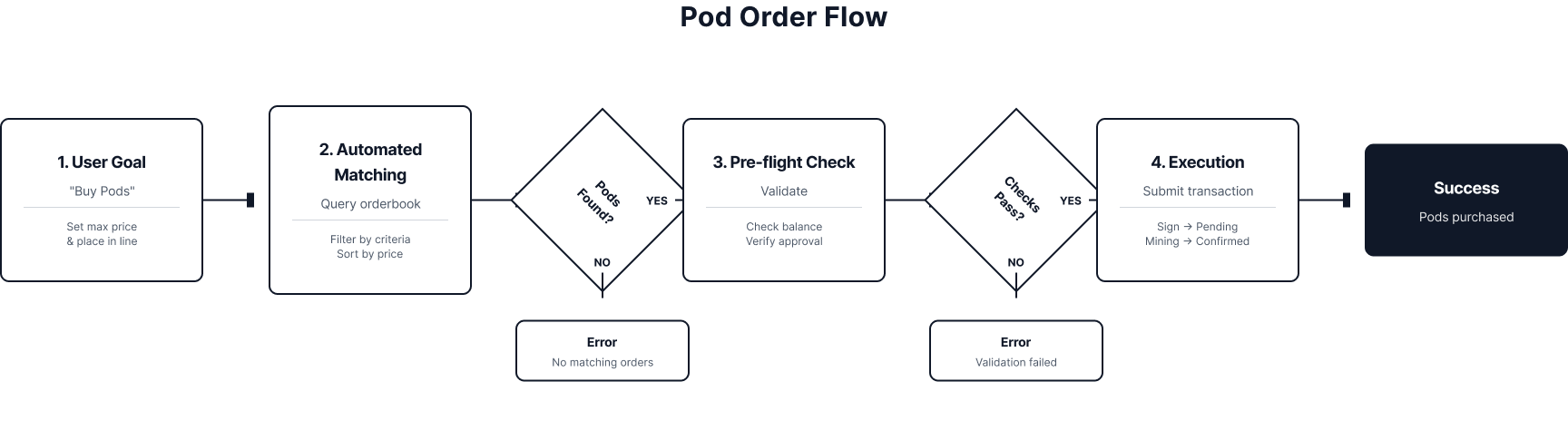

The Focus: Complexity abstraction, intent-based design, and proactive transparency.

The Challenge: How do we make an algorithmic credit facility feel as safe as a traditional savings account?

The Goal: Establish immediate trust and reduce user error by moving from manual trading to automated "intent".

Collaboration

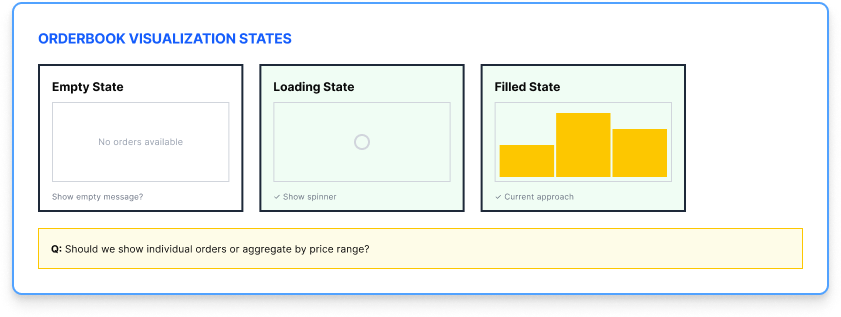

In the early days of pinto, there was no handbook. I sat in the "messy middle," leading technical conversations with smart contract engineers to understand exactly how the pod orders and liquidity matching functioned.

Speed vs. Rigor: I balanced the need for a fast launch with the requirement for institutional-grade design standards to prevent technical debt from piling up as we scaled.

Designing for Intent

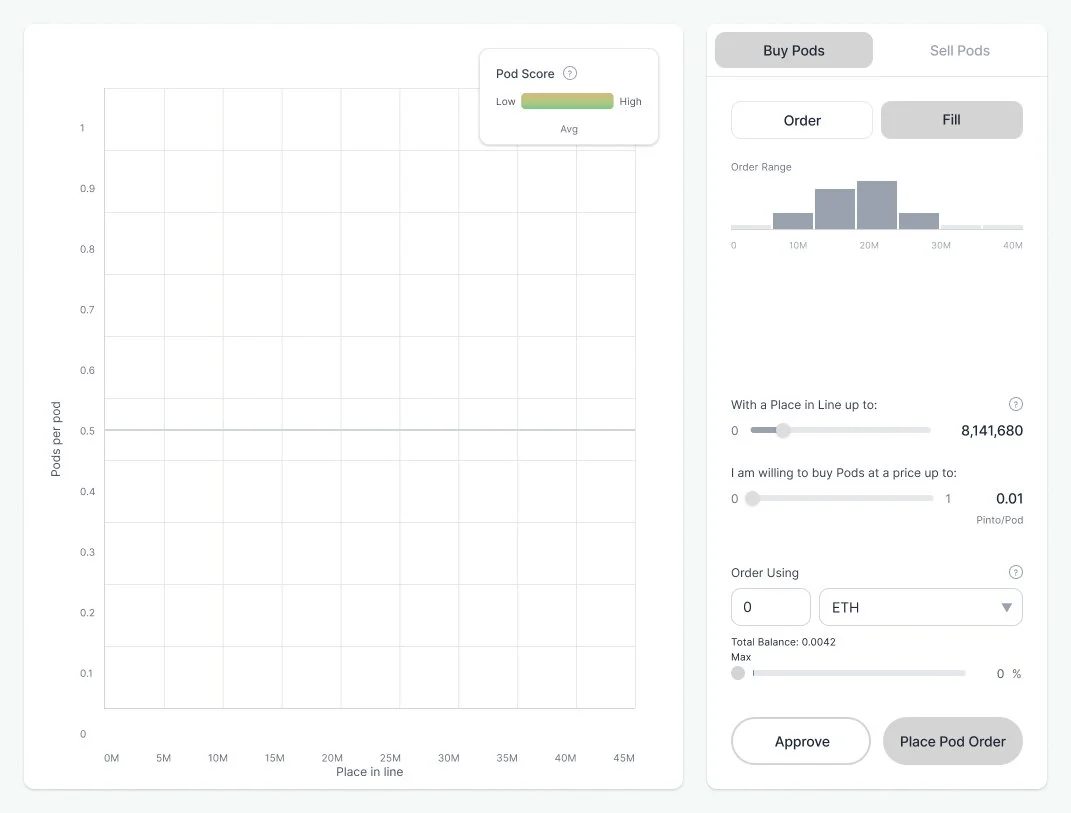

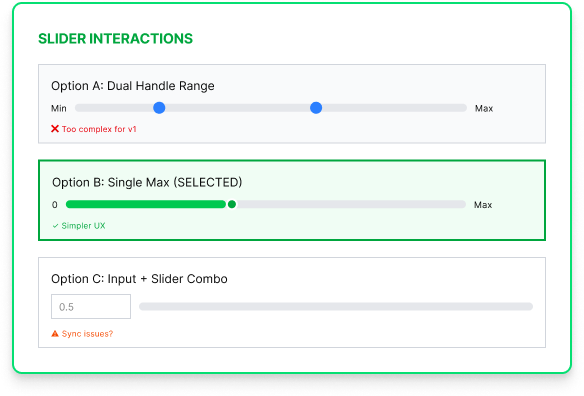

We made a fundamental shift from manual workflows to intent-based design. Instead of making users manage the plumbing, we designed for the outcome.

The Human-in-the-Loop: While the protocol handles the automation, the user remains the final authority.

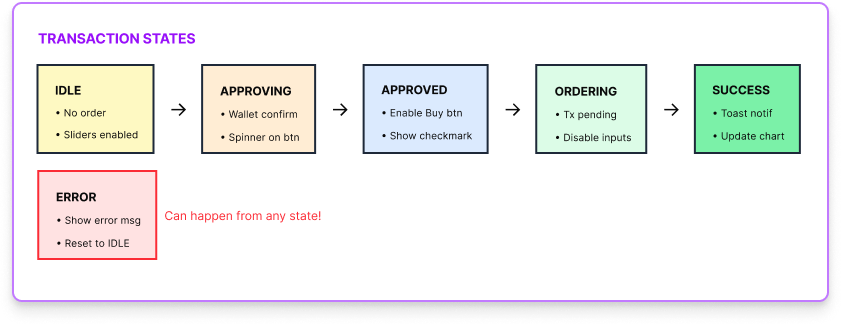

Standardized Trust: I architected a specialized web3 component library to handle the unique lifecycle of a transaction, from "awaiting signature" to "indexing on-chain".

Final Screen Overview

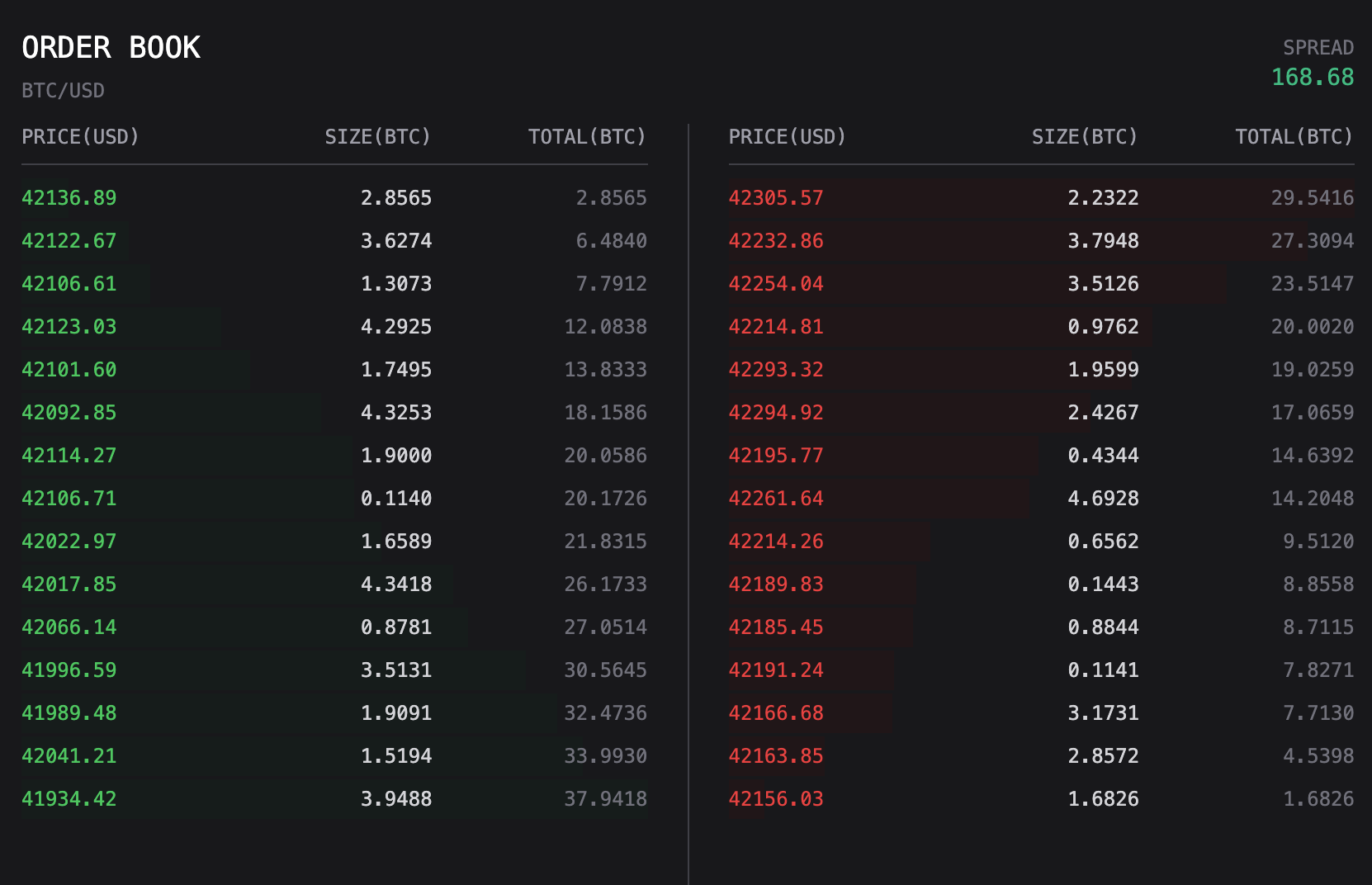

This is the operational hub. I designed this to give users an instant pulse on the market by prioritizing global metrics like pinto price and total liquidity.

This is our most critical component. Before a user signs a transaction, we translate raw smart contract code into human-readable English.